When it comes to housing assistance programs, the Total Household Rental Voucher Amount plays a crucial role in helping families secure stable and affordable living arrangements. In many regions, governments offer housing subsidies to low-income households, and understanding how the rental voucher system works is key for families in need of financial assistance.

In this article, we’ll dive deep into the concept of the Total Household Rental Voucher Amount, its components, eligibility requirements, how it’s calculated, and how families can use it to alleviate housing costs.

What is a Total Household Rental Voucher Amount?

A rental voucher is a form of financial assistance provided by government agencies to help low-income families, individuals, or households afford housing in the private rental market. The Total Household Rental Voucher Amount refers to the total amount of money a household receives through a rental voucher to cover a portion of their monthly rent. This amount is determined based on several factors, including the household’s income, family size, the local housing market, and the area’s specific housing costs.

One of the most well-known rental assistance programs in the United States is the Housing Choice Voucher Program (HCV), commonly referred to as Section 8. Under this program, eligible families receive a voucher that covers a portion of their rent, allowing them to live in privately owned rental properties. The Total Household Rental Voucher Amount in this case is what the government contributes towards the family’s housing expenses.

How is the Total Household Rental Voucher Amount Determined?

The Total Household Rental Voucher Amount is not a fixed amount. It varies based on several key factors, and the formula used to calculate it is designed to reflect both the household’s financial situation and the cost of housing in their area. Below are some of the most critical factors that affect the determination of the voucher amount:

1. Household Income

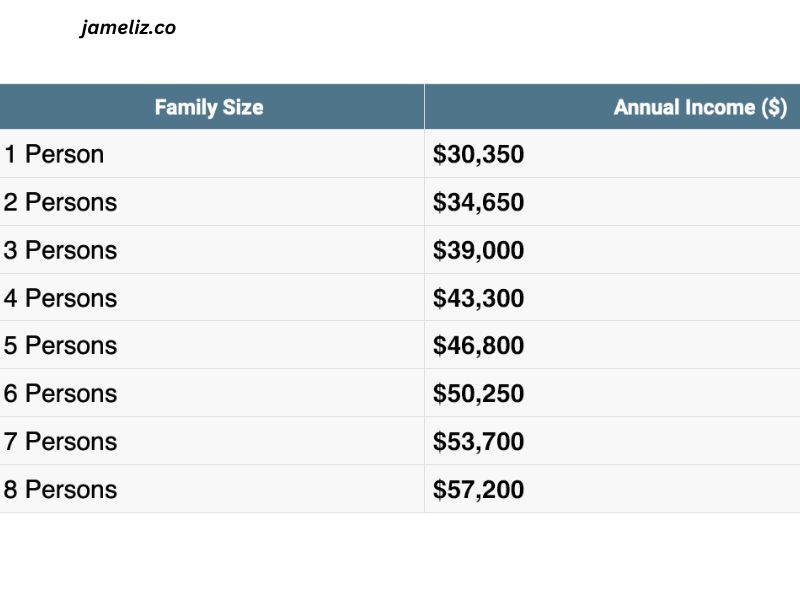

The household’s total income is the primary factor that determines how much assistance a family can receive. The lower the income, the higher the rental subsidy. Most housing programs set limits on the maximum income level a family can have to qualify for rental assistance. Generally, eligible households must earn no more than 50% of the area’s median income (AMI), but this can vary based on local regulations.

2. Family Size

The size of the household also plays a role in determining the voucher amount. Larger families may be eligible for a higher subsidy due to their increased need for space. This factor ensures that families have sufficient resources to cover the costs of housing appropriate for their size.

3. Fair Market Rent (FMR)

Fair Market Rent (FMR) is the estimated rent for a specific area based on the average rental prices in that region. Housing authorities use the FMR to determine the maximum allowable rent for a unit in a given area. The Total Household Rental Voucher Amount is usually based on the FMR, meaning that the rental assistance provided will cover a portion of the rent, up to the FMR amount for that region.

4. Payment Standard

In some cases, the Total Household Rental Voucher Amount is also determined by a payment standard. The payment standard is the maximum rent a family can be assisted with, based on the FMR in their area. If the rent exceeds this standard, the family may be required to cover the difference.

5. Tenant Contribution

Even though the voucher covers a portion of the rent, tenants are still required to contribute a certain percentage of their income toward the rent. Typically, households are expected to pay 30% of their adjusted income for rent. The amount a household contributes will be subtracted from the total rent, and the remaining balance will be covered by the voucher. This means that as the household income increases, the tenant’s contribution to the rent also increases.

6. Location

The rental rates in the area where the household lives or plans to live are a significant factor. For instance, families living in high-cost cities or neighborhoods might receive higher rental vouchers compared to those in more affordable areas. This helps ensure that the voucher’s value matches local rent prices, allowing families to live in neighborhoods that suit their needs.

How Do Families Apply for Rental Vouchers?

Obtaining rental assistance involves an application process that varies depending on the program or the region. In the case of the Housing Choice Voucher (HCV) program, families typically need to apply through their local Public Housing Authority (PHA). The application process involves providing proof of income, family size, and any other necessary documentation.

Once a household is deemed eligible, they are placed on a waiting list, as demand for rental assistance often exceeds the available funding. The waiting time can vary, sometimes taking months or even years. Once their application is processed and they are granted a voucher, the Total Household Rental Voucher Amount is determined based on the factors outlined above.

How to Use the Total Household Rental Voucher Amount

Once a family is awarded a rental voucher, they can use it to rent a unit that meets the program’s criteria. The Total Household Rental Voucher Amount will cover a portion of the rent, and the tenant will be responsible for paying the remainder. How ever, the amount the tenant contributes depends on their income and the program’s payment standards.

The rental voucher can be used to rent privately owned properties, as long as the landlord agrees to participate in the program. Tenants are typically required to find their own housing, and once they do, the housing unit must pass an inspection to ensure it meets certain safety and quality standards.

Benefits of the Total Household Rental Voucher Amount

The Total Household Rental Voucher Amount offers several benefits, especially for families struggling to make ends meet. Some of the most significant advantages include:

- Affordability: Rental vouchers make it easier for families to afford housing in high-demand rental markets, where rent prices may be otherwise unaffordable.

- Stability: The rental assistance reduces the financial burden on households, providing greater housing stability and reducing the risk of homelessness.

- Choice of Housing: In many cases, households can choose where they want to live within the boundaries of their rental voucher’s amount and the FMR. This allows families to live in safer neighborhoods with better access to schools, healthcare, and employment opportunities.

- Improved Quality of Life: By receiving assistance with rent, families can focus on other important aspects of life, such as healthcare, education, and job opportunities, rather than worrying about where they will live or how they will pay rent.

Challenges and Limitations

While the Total Household Rental Voucher Amount provides significant assistance, there are some limitations and challenges that applicants and recipients should be aware of:

- Waiting Lists: Due to high demand and limited funding, many families are placed on waiting lists for rental assistance, which can lead to long waiting periods. This means some families may need to wait for months or even years before receiving help.

- Limited Voucher Amount: The rental voucher may not always cover the full cost of rent, especially in high-cost areas. Families may need to supplement the voucher with their own funds to secure housing.

- Property Availability: Not all landlords accept rental vouchers, and families may face challenges finding suitable housing within their voucher’s value, particularly in competitive housing markets.

- Eligibility Changes: If a family’s income increases or they experience other changes in their financial situation, their eligibility for rental assistance may change, which can affect the voucher amount they receive.

Conclusion

The Total Household Rental Voucher Amount plays a pivotal role in helping low-income families access stable and affordable housing. By providing financial assistance for rent, these vouchers alleviate the burden of high housing costs, promote greater housing stability, and allow families to live in neighborhoods that improve their quality of life.

While rental assistance programs like the Housing Choice Voucher Program offer substantial benefits, understanding how the voucher amount is determined and the eligibility requirements is crucial for anyone seeking assistance. With the right information and support, families can navigate the process of obtaining and utilizing rental assistance to ensure a more secure and stable future.